Siemens, Nokia, Infineon, Onsemi, and Black Semiconductor are making targeted acquisitions to expand their capabilities in manufacturing, connectivity, and advanced materials.

Siemens, Nokia, Infineon, Onsemi, and Black Semiconductor are making targeted acquisitions to expand their capabilities in manufacturing, connectivity, and advanced materials.

Several major semiconductor companies have announced acquisitions aimed at strengthening their positions in key technology areas. From AI-ready optical networks to automotive Ethernet and next-gen PCB workflows, these deals reflect ongoing efforts to streamline product development, expand into adjacent markets, and secure long-term growth. Here's a look at the most recent moves and what they mean for the industry.

1. Siemens Acquires DownStream Technologies

Siemens has bought Downstream Technologies, a company that builds software to prepare PCB designs for manufacturing. This gives Siemens stronger tools to support the handoff between PCB design and production, especially for smaller and mid-sized businesses that need tighter workflows without adding complexity.

Downstream’s tools—CAM350, BluePrint-PCB, and DFMStream—focus on cleaning up and validating design data before it reaches the factory floor. These tools help catch issues early, reduce manual steps, and generate the documents manufacturers need to build the board properly. Siemens plans to fold these resources into its existing electronics design tools, which should create a more direct and reliable process from schematic to finished board.

CAM350 is the industry standard for verification, optimization, and output generation to efficiently drive PCB fabrication. Image used courtesy of Downstream Technologies

Thanks to this acquisition, customers should see fewer bottlenecks between design and production, especially in areas like design-for-manufacturing checks and documentation. For engineers, this means better integration between tools, fewer errors late in the process, and less jumping between disconnected systems. Teams can move faster and hand off designs with more confidence that they’ll build correctly the first time.

2. Nokia Acquires Infinera

Nokia has acquired Infinera for $2.3B to expand its position in optical networking and gain a stronger foothold in the data center market. Infinera brings high-speed, low-power optical components that support AI workloads, especially in large, distributed data centers.

This deal nearly doubles the size of Nokia’s Optical Networks division and boosts its presence in North America, where Infinera has a strong base. It also helps Nokia move faster with its product roadmap and compete more directly with players like Ciena and Cisco.

The acquisition targets growing demand for data center interconnects and next-gen optical transport. Nokia plans to hit over $223M in profit synergies by 2027, mostly through supply chain and operating efficiencies.

3. Infineon Acquires Marvell’s Ethernet Business

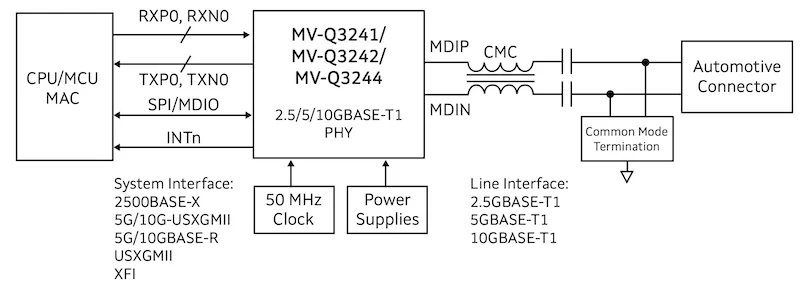

Infineon is buying Marvell’s automotive Ethernet business for $2.5B in a cash deal, giving Infineon direct access to high-speed, in-vehicle networking tech that’s becoming standard in modern car designs. The deal folds in Marvell’s full Brightlane product line, including Ethernet PHYs, switches, and bridges. These products support data rates up to 10 Gbps and are built to handle the security and reliability demands of car networks.

Block diagram of Marvell's MV-Q3244 automotive 802.3ch compliant10GBase-T1 PHY. Image used courtesy of Marvell Technology

The move expands Infineon’s offering beyond microcontrollers into Ethernet networking, which is key for software-defined vehicles. Features like driver-assist, over-the-air updates, and zonal computing all rely on fast, secure communication across many systems. By combining Marvell’s networking hardware with its own Aurix microcontroller family, Infineon plans to deliver a more complete platform for automakers building next-gen electrical architectures.

This acquisition also brings in Marvell’s customer base of more than 50 automotive manufacturers, including most of the top global OEMs. Infineon gets a $4B design-win pipeline and a team of Ethernet engineers across the U.S., Germany, and Asia. The acquired business is profitable and growing, with projected 2025 revenue of up to $250M and a gross margin of around 60%.

If you work in automotive electronics or embedded systems, this means more convergence of control and networking hardware from one vendor. Over time, it could lead to better-optimized hardware platforms and tighter integration between processors and networking components. It may also affect how you source or architect your designs, especially if you’re working on zonal or software-defined platforms.

4. Onsemi Proposes Acquisition of Allegro Microsystems

Onsemi has made a public offer to acquire Allegro MicroSystems for $6.9B in cash after several failed private attempts. The proposal values Allegro at $35.10 per share, a 57% premium over its last unaffected stock price. Allegro’s board rejected the offer, calling it inadequate, but hasn’t ruled out further discussions.

The logic behind the offer is straightforward. Onsemi and Allegro target similar markets—automotive, industrial, and data center infrastructure—but from different angles. Allegro brings strength in magnetic sensors and analog power ICs, especially in automotive and industrial settings. Onsemi is already a major player in intelligent power and sensing and sees Allegro’s portfolio as a strong fit that could deepen its reach and accelerate product development in EVs, factory automation, and AI-powered data center applications.

Both companies are also facing slower demand and shrinking valuations. Allegro’s automotive revenue dropped 33% year-over-year in late 2024, and Onsemi saw a 14% decline in total revenue. Onsemi announced layoffs earlier this year, cutting 2,400 jobs to trim costs. If the acquisition is to move forward, it could mean more streamlined access to a wider product set across power, sensing, and control. It might also drive tighter integration between sensors and power ICs, especially in automotive systems.

5. Black Semi Acquires Applied Nanolayers

Black Semiconductor has acquired Applied Nanolayers (ANL), a Dutch company known for its work in graphene materials, to fast-track the development of its graphene-based chip technology. This acquisition gives Black Semi access to ANL’s semi-automated 200-mm wafer process for graphene integration—capable of producing 10,000 wafers a year—plus the expertise of a 10-person team that’s been working on scalable graphene manufacturing for over a decade. Black Semi plans to scale this to a 300-mm process to hit over one million wafers annually by 2029.

The Black Semiconductor team. Image used courtesy of Black Semiconductor

Graphene plays a central role in Black Semi’s vision for Integrated Graphene Photonics (IGP), a platform meant to merge electronic and photonic data transfer on the same chip. The goal is to enable fast, low-power communication between thousands of chips working together as a single unit. This type of architecture targets high-demand areas like AI, robotics, autonomous driving, and high-performance computing.

The deal also fits with Black Semi's ramp-up at its new FabOne site, where it plans to launch a pilot production line for IGP chips in 2026. With ANL’s tech, Black Semi expects to cut two years off its development timeline. The acquisition also helps solidify Europe’s position in graphene-based semiconductors, a space that’s expected to grow significantly over the next few years.

-

Tel

+86 180 2549 2789 -

Wechat

BOM

BOM Cart()

Cart() English

English Russia

Russia Korean

Korean